The ATO has stuck to their guns on the view that a Trust Split creates a new trust (and hence a CGT Event), however they have made it clear that a separation of powers within a trust (which I call an ‘Internal Trust Split’) will not trigger CGT. An Internal Trust Split has been a strategy for segregating trust assets I have used more and more for clients since TD 2018/D3, and so it is good news that there is CGT certainty for that strategy.

On Friday 13th December 2019 (an unlucky day?) the ATO has finally published a completed version of the Draft ruling TD 2018/D3 (explained here and now called TD 2019/14). Initial feedback I received from the ATO was that we would have the final ruling by December 2018… I guess the ‘December’ part of that indication was correct!

What If I Have Effected a Trust Split in the Past?

The ATO has given a bit of comfort to people who have done a Trust Split, while keeping the door open, saying

“It is recognised that the Commissioner’s view of the potential CGT implications of the arrangement discussed in this Determination may have been subject to conjecture prior to the publication of TD 2018/D3 on 11 July 2018. The Commissioner will not devote compliance resources to apply the views expressed in this Determination to arrangements entered into before this date. However, if the Commissioner is asked or required to state a view (for example, in a private ruling or in submissions in a litigation matter), the Commissioner will do so consistently with the views set out in this Determination.”

In my view what this means is that the ATO will not be actively looking for Trust Splits by way of audit, but if they happen to stumble upon one then they will impose CGT – so be careful with your submissions!

What Creates a New Trust?

In my view that ATO has actually made more of a legal mess with this final ruling, but it is a mess that we can deal with in a practical sense.

TD 2019/14 continues with adopting the ‘New Trust View’ (as explained in more detail here). However, in response to the submission that I made on that point there is no real explanation given.

I said:

“[On the ‘New Trust View’] Every change in trustee will create a new trust. However, as a matter of policy, the creation of the new trust is generally ignored. If the ATO adopts the view that CGT is incurred upon a trust split, then there is no rationale for not applying CGT to every change in trustee. The only way to distinguish a ‘trust split’ and a mere change in trustee is for legislative amendment.”

To which the ATO replied:

“We do not agree that a mere change in trustee will create a new trust. In the Commissioner’s view it is the combination of factors set out in the final Determination which causes assets vested in a separate trustee to be settled on a new trust distinct from the existing (and continuing) trust.”

So the ATO doesn’t adopt the New Trust View more generally, but they do adopt that view in relation to Trust Splitting only. Their view is somewhat No New Trust View. Maybe they haven’t put trust resettlement back on the table.

What Can We Do Now?

The ATO gives a new Example 2 to contrast Trust Splitting with something that is allowable:

“Ian and Maria King decide that now is an appropriate time for greater responsibility for the administration of the Kingdom Family Trust to be placed on Laura who is currently taking increased responsibility for the property development business. To facilitate the desired succession planning goal, the trust deed is amended to:

(a) allow for the appointment of additional trustees in respect of some of the assets of the trust fund

(b) allow for separate appointors in respect of the different parts of the trust fund

(c) provide that in making a determination about how to distribute the net income of the trust fund for a particular accounting period, each trustee of any separate part/s of the trust fund must take into account the losses incurred by the other parts of the trust fund and expenses of the trust as a whole

(d) require all trustees to act together in respect of decisions which one trustee reasonably believes requires agreement of all trustees including but not limited to

(i) selection of an accountant for preparation of the trust tax return

(ii) incurring joint expenses

(iii) amending the trust deed

(iv) determining an earlier vesting date for the trust, and

(e) give each trustee recourse to all of the trust assets where the assets held by that trustee are insufficient to fully satisfy its right to be indemnified.

A Deed of Appointment was subsequently executed appointing Rainbow Pty Ltd (Rainbow) as an additional trustee over all assets relating to the property development business of the Kingdom Family Trust. Laura and Ian King are the directors and shareholders of Rainbow. Emperor is removed as trustee over all assets relating to the property development business.”

What I would describe this as is an “Internal Trust Split”.

What Is An Internal Split?

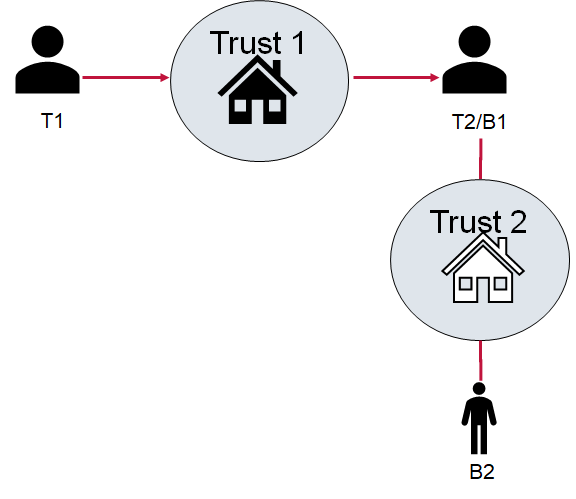

An Internal Trust Split is where control over one or more assets (the “Split Assets”) are separated from other assets (“Other Assets”) of the trust. There are various levels of separation that can be effected, while still keeping the assets with the same trust.

Segregation

The most basic is to begin separately administering different assets of a trust. One driver of this might be for management accounting. A trust that owns Blackacre and Whiteacre might wish to separately assess the performance of the assets to assist the decision making of the trustee. Therefore the trustee ‘Segregates’ Blackacre from Whiteacre.

Rights of Control

Another option is to grant various rights of control over a particular assets. These might be:

- Appointorship – the power to appoint or remove the trustee;

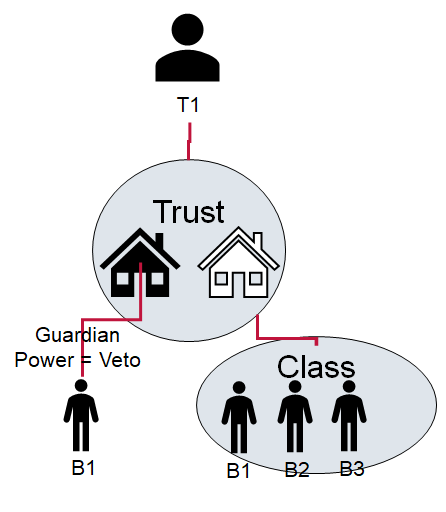

- Guardianship – the ability to veto decisions of the trustee in relation to that particular asset

- Distributorship – the ability to positively direct the trustee to make decisions in relation to a particular asset

- Or all of the above

For example, if the Widow of the founder of the trust resides in Blackacre, she could be given the power of Guardianship over Blackacre so that she can veto any attempt to sell the property or move her out. The control over the trust and management of its other assets could then be given to the children of the founder of the trust with reassurance that the Widow will not be evicted from Blackacre. This is a much simpler and more tax effective alternative to creating a life estate.

Class Trust

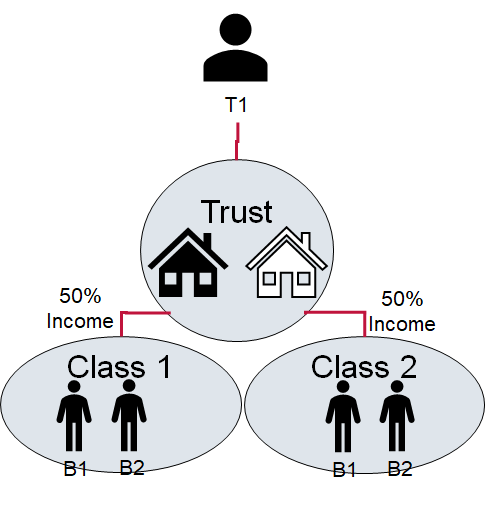

These various rights of control can be also be granted in relation to a percentages of income and capital of the trust. In that way a ‘share’ of the trust can be passed to a specific person, much as could be done with units in a unit trust.

For example, the Son and Daughter are each given Distributorship over 50% of the income and capital of the trust. If there was a falling out between them, then each could force the trust to distribute their respective 50% ‘share’ where they wished. A trust set up like this is often called a “Class Trust”.

Custodian Trustee

A custodian/nominee/bare trustee can also be appointed over a particular asset so that the legal ownership and the day to day control of that asset is separated.

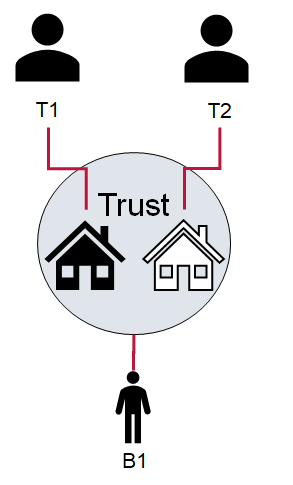

For example, T1 a custodian trustee is appointed as trustee over Blackacre to hold it for the benefit of T2 the trustee who holds Whiteacre (plus the beneficial interest in Blackacre) for the beneficiary B1. Provided that T2 is absolutely entitled to the assets of Trust 1 (i.e. Blackacre) then Trust 1 will be ignored. See TR 2004/D25 and GSTR 2008/3

The more of the above are adopted, the greater the extent of the Internal Trust Split. The Example 2 in TD 2019/14 encompasses all of the above.

The standard Cartland Law Discretionary Trust Deed is set up to be able to Internally or Externally Split with further need for amendment.

What Is Too Far?

One of the key points of distinction between an Internal and External Trust Split in the view of the ATO is whether the trustee’s right of indemnity extends across the Split Asset. This is the same nonsensical reasoning that the (now withdrawn) ATO ID 2009/86 on trust splitting was based on. This was explained to the ATO by myself and a number of others:

“The references to rights of indemnity are not relevant. Those rights are personal to a trustee arising from the personal liability of that trustee. A trustee cannot have personal liability for the acts of another or arising from property held by another. It follows there is no right of indemnity in that case. If the original trustee waives its rights of indemnity over assets transferred to the separate trustee that is a personal matter.”

This wasn’t answered particularly well by the ATO:

“The attempt to limit the assets to which each respective trustee can look to make good their right to be indemnified as part of the implementation of the trust split is, in conjunction with the other steps of the split, relevant to the conclusion that the split causes the assets transferred to the separate trustee, to be subject to a new charter of rights and obligations.”

Therefore on the ATO’s view if you leave an (irrelevant, personal) right of indemnity of the trustee across all of the assets of the trust then there will be no External Trust Split, and hence no CGT. The right of indemnity across all of the assets seems to be the touchstone that separates an Internal Split from and External Split.

On an Internal Split there will only be on TFN and ABN for the trust, even if there are multiple (custodian) trustees.

Adrian is the Creator of Ailira, the Artificial Intelligence that automates legal information and research, and the Principal of Cartland Law, a firm that specialises in devising novel solutions to complex tax, commercial and technological legal issues and transactions.