The Land Tax Act 1936 (SA) has recently been amended by the Land Tax (Miscellaneous) Amendment Act 2019 (SA), which has introduced significant changes to:

- the fees and rates applicable to different landholders; and

- the grouping of landholders.

These changes will apply to the assessment of Land Tax in the 2020-21 year onwards.

This guide will introduce you to these changes and provide some helpful Land Tax structuring tips and tricks.

***Download the Cartland Law Land Tax Guide Here***

Land Tax Rates

Current Land Tax Rates 2019-20

| Net Taxable Site Value | 2019-20 Rate |

| $0 – $391,000 | nil |

| $391,001 – $716,000 | 0.50% |

| $716,001 – $1,042,000 | $1,625 + 1.65% |

| $1,042,001 – $1,302,000 | $7,004 + 2.4% |

| $1,302,0001 – over | $13,244 + 3.70% |

New Land Tax Rates 2020-21

| Net Taxable Site Value | General Rate | Trust Rate |

| $0 – $25,000 | nil | nil |

| $25,001 – $450,000 | nil | $125 + 0.50% |

| $450,001 – $755,000 | $0 + 0.50% | $2,250 + 1.00% |

| $755,001 – $1,098,000 | $1,525 + 1.25% | $5,300 + 1.75% |

| $1,098,001 – $1,350,000 | $5,812.50 + 2.00% | $11,302.50 + 2.40% |

| $1,350,001 – over | $10,852.50 + 2.40% | $17,350.50 + 2.40% |

New Land Tax Rates 2021-22

| Net Taxable Site Value | General Rate | Trust Rate |

| $0 – $25,000 | nil | nil |

| $25,001 – $464,000 | nil | $125 + 0.50% |

| $464,001 – $778,000 | $0 + 0.50% | $2,320 + 1.00% |

| $778,001 – $1,131,000 | $1,570 + 1.25% | $5,460 + 1.75% |

| $1,131,001 – $1,350,000 | $5,982.50 + 2.00% | $11,637.50 + 2.40% |

| $1,350,001 – over | $10,362.50 + 2.40% | $16,893.50 + 2.40% |

New Land Tax Rates 2022-23

| Net Taxable Site Value | General Rate | Trust Rate |

| $0 – $25,000 | nil | nil |

| $25,001 – $477,000 | nil | $125 + 0.50% |

| $477,001 – $801,000 | $0 + 0.50% | $2,385 + 1.00% |

| $801,001 – $1,165,000 | $1,620 + 1.00% | $5,625 + 1.50% |

| $1,165,001 – $2,000,000 | $5,260 + 2.00% | $11,085 + 2.40% |

| $2,000,001 – over | $21,960 + 2.40% | $31,125 + 2.40% |

Summary of Taxpayers and Rates

| Landholder | Who is assessed? | General Rate | Trust Rate |

| Individual | Individual | ||

| More than one individual jointly or as tenants in common |

The ownership Each individual (with credit) |

||

| Company | Group of related companies | ||

| Excluded trusts including SMSFs, charitable trusts, special disability trusts and administration trusts (deceased estates) | Trust | ||

| Discretionary trust | Trust | ||

| Discretionary trust with a designated beneficiary |

Trust Designated beneficiary (with credit) |

||

| Unit or fixed trust | Trust | ||

| Unit or fixed trust with notification of underlying beneficial interests in the trust / unit holders |

Trust The unit holder (with credit) |

Example Calculations

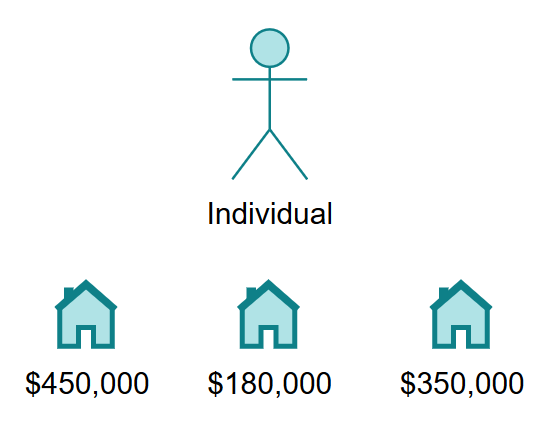

An individual holds three properties with a net taxable site value of $980,000.

The individual will be assessed at the General Rate.

Land Tax = $1,525 + 0.0125 x (980,000 – 755,000) = $4,337.50

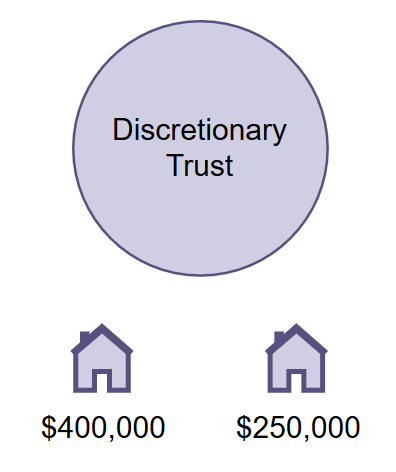

A discretionary trust holds two properties with a net taxable site value of $650,000.

The trust will be assessed at the Trust Rate.

Land Tax = $2,250 + 0.01 x (650,000 – 450,000) = $4,250

Cartland Law Land Tax Calculator

Calculating the potential Land Tax liabilities of you and your related entities is crucial before making the important notifications detailed in the next section.

To help with your Land Tax calculations, we’ve prepared a free Land Tax Calculator.

How to use the Land Tax Calculator:

- First, add the details of each land holding entity in your group. For example, this could be individuals such as you and your spouse, your family trust, investment trust, and a company.

- If the entity is a trust, then a box will appear, enabling you to select one of the individuals in your group as the nominated beneficiary of that trust.

- Next, add the details of each property, its taxable site value, and select which entity within your group owns that property (from the drop-down menu). If that property is your principal place of residence or otherwise exempt from Land Tax, then either tick the box labelled “PPR” or simply don’t enter that property into the Land Tax Calculator.

- Then hit “Calculate” and take a look at your possible Land Tax liability for the 2020-21, 2021-22, and 2022-23 years.

- You can use the Land Tax Calculator as many times as you like to test out how nominating different beneficiaries will affect your Land Tax.

We note that due to the complexity of the new credit system in relation to joint ownerships, the Land Tax Calculator only provides the overall Land Tax payable by the underlying joint holder and not the first instance assessment. This can be done manually, as shown in this guide, or please feel free to contact us for assistance.

Trust Notifications

Important Action is required prior to 30 June 2020

Decisions regarding notification of designated beneficiaries (in the case of discretionary trusts) and beneficial interests (in the case of unit or fixed trusts) must be made by 30 June 2020 to apply in the 2020-21 year.

Discretionary Trust Notifications

s13A of the Act

A trustee may provide a once-off notification to the Commissioner nominating an individual to be the designated beneficiary of the trust. [1] If a nomination is made, the land will first be assessed to the trustee at the General Rate and will then be attributed to the individual. A credit for tax paid will be applied to the individual’s assessment.

Requirements:

- the land must have been held in the trust prior to 16 October 2019[2];

- notice must be provided by 30 June 2020 (to be effective from the 2020-21 year) or by 30 June 2021 (to be effective from the 2021-22 year)[3]; and

- the designated beneficiary must:

- be a natural person;

- be a beneficiary of the trust as at 16 October 2019;

- be over 18 years old; and

- have consented by statutory declaration to be the designated beneficiary.

- Restrictions: there can only be one designated beneficiary of the trust;

- all eligible land within the trust will be attributed to the designated beneficiary;

- a designated beneficiary may be substituted in the event of death, incapacity, or the breakdown of a marriage/relationship; and

- if a designated beneficiary withdraws their consent, then no new designated beneficiary can be nominated.

[1] the nomination is administrative only and in no way effects the interests of persons in the trust property.

[2] land which becomes subject to the trust after this date will be assessed to the trustee at the Trust Rate – the relevant calculation is provided in s13A(9)(c) of the Act. Note the requirement for calculations to be made on the net taxable site value of all land held within the trust with apportionment for pre and post-date land.

[3] A designated beneficiary cannot be nominated after 30 June 2021.

Unit or Fixed Trust Notifications

s12, 13, 13D(6)&(7) of the Act

A trustee may provide a voluntary notification to the Commissioner specifying the holders of underlying beneficial interests/unit holders in the trust. If notification is provided, the land will first be assessed to the trustee at the General Rate and will then be attributed to the unit holder/s. A credit for tax paid will be applied to the unit holders’ assessments.

Requirements:

- the notice must specify in which year the notice is to take effect (it may take effect in the tax year in which the notice is lodged or the following year);

- a notice must specify all unit holders in the trust[1]; and

- (if a notice is in place) the Commissioner must be notified within one month of any change to the unit holders in the trust.

Restrictions: if the trustee withdraws a notice, then no new notice may be made in relation to the trust (a notice re: change in unit holders does not constitute a withdrawal of notice).

[1] There is no option to notify in relation to only some of the beneficial interests.

Credit system

Multiple assessments (where a credit for tax paid under one assessment is applied to another) operates for land held by:

- multiple landholders;

- discretionary trusts (with a designated beneficiary); and

- unit or fixed trusts (with notice of beneficial interests / unit holdings).

Note:

- the amount of the credit is equal to the landholder’s proportionate interest in the land irrespective of who actually paid the first instance assessment;

- a credit cannot reduce a landholders Land Tax liability below zero; and

- any excess credits are extinguished and cannot result in a refund, be applied to a later assessment, or be applied to the assessment of another entity.

Multiple landholders

Land may be held by more than one landholder either:

- Jointly: where each owner owns the whole of the land together; or

- Tenants in Common: where each owner owns a specific percentage of the land

Where multiple people own land together, that land will be aggregated with all other land held by those same people. The land will not be aggregated with land held by the people individually or by the people together with other persons. This appears to be the case regardless of if the land is held jointly or as tenants in common and irrespective of differing percentage ownerships in the land.

The registered landholders will first be assessed at the General Rate on this basis (i.e. as if they were one landholder). [1]

The proportion of the land held by each landholder will then be attributed to them. A credit equal to their proportion of tax paid will be applied to each landholder’s assessment.

[1] Assuming the Commissioner has not exercised discretion under s9 if the Act to treat one or more of the owners as the sole owner and taxpayer for the land. Note that this discretion is exercisable regardless of the capacity in which the land is held, the owners’ proportionate holdings, and irrespective of the intentions of the landholders. the former requirement that the Commissioner must be satisfied that one of the purposes for the manner of holding was to reduce a holder’s Land Tax liability has been removed.

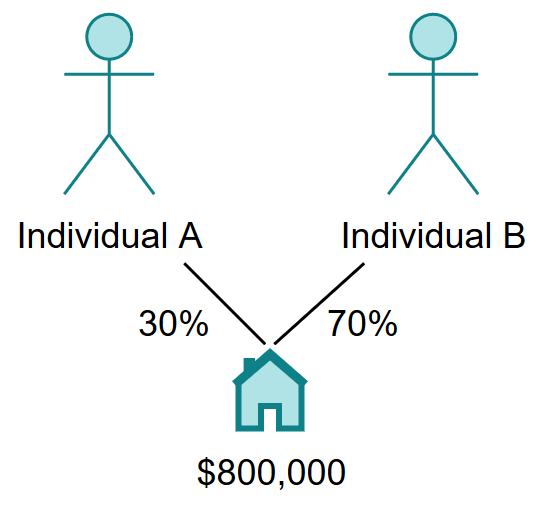

Land with a net taxable site value of $800,000 is held by two individuals as tenants in common.

Ownership Land Tax = $1,525 + 0.0125 x (800,000 – 755,000) = $2,087.50

Individual A’s Land Tax = $0

Individual B’s Land Tax = $0 + 0.005 x (560,000 – 450,000) = $550

(less credit of $1,461.25) = $0

Discretionary Trusts

The trustee will first be assessed at the General Rate.

The land held in trust will then be attributed to the designated beneficiary. A credit equal to the tax paid will be applied to the individual’s assessment.

Example 4:

Land with a net taxable site value of $550,000 is held by a trust with a designated beneficiary who holds an additional $1M of land.

Trust’s Land Tax = $0 + 0.005 x (550,000 – 450,000) = $500

Individual’s Land Tax = $10,852.50 + 0.024 x (1,550,000 – 1,350,000) = $15,652.50

(less credit of $500) = $15,152.50

TOTAL = $15,652.50

In this situation less Land Tax would be paid if there were no designated beneficiary of the trust.

Land Tax payable if no designated beneficiary:

Trust’s Land Tax = $2,250 + 0.01 x (550,000 – 450,000) = $3,250

Individual’s Land Tax = $1,525 + 0.0125 x (1,000,000 – 755,000) = $4,587.50

TOTAL = $7,837.50

Unit or Fixed Trusts

The trustee will first be assessed at the General Rate.

The proportion of the land held by each unit holder will then be attributed to them. A credit equal to their proportion of tax paid will be applied to each unit holder’s assessment.

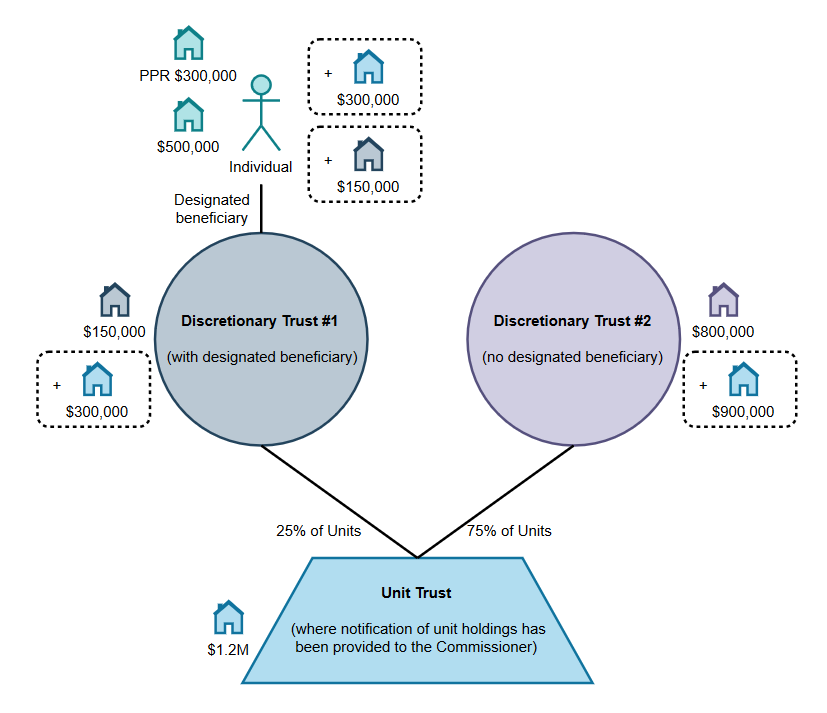

Example 5:

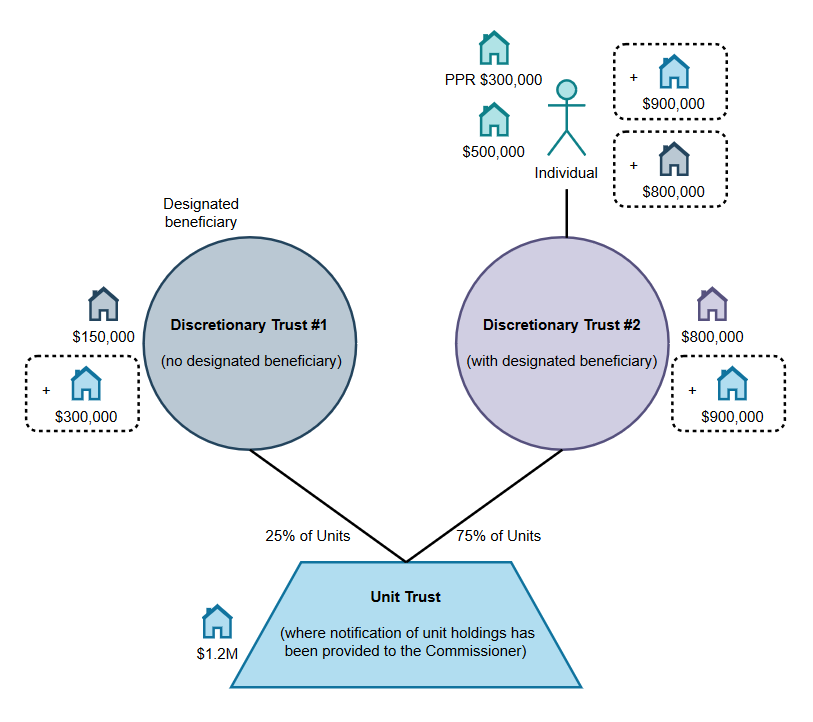

A Unit Trust holds $1.2M of land. Trust #1 holds 25% of the units in the Unit Trust and $150,000 of additional land. Trust #2 holds 75% of the units in the Unit Trust and $800,000 of additional land. The Individual is the designated beneficiary of Trust #1 and holds their principal place of residence and $500,000 of additional land.

The Land Tax payable across the group of entities has been calculated and a summary is provided in the table below.

| Landholder | Rate | Net taxable site value | Credit | Land Tax |

| Unit Trust | General Rate | $1.2M | n/a | $7,852.50 |

| Trust #1 | General Rate | $450,000 | $1,963.10 | $0 |

| Trust #2 | Trust Rate | $1.7M | $5,889.40 | $19,861.10 |

| Individual | General Rate | $950,000 (PPR is exempt) |

$1,963.10 $0 |

$1,999.40 |

TOTAL = $29,713

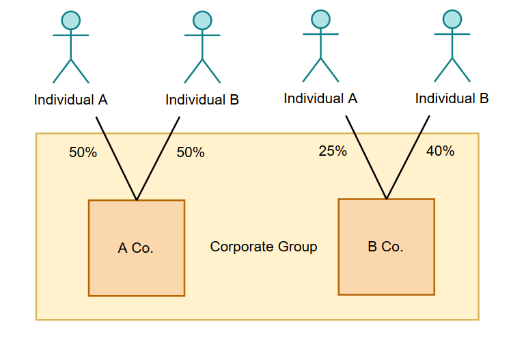

Groups of Related Companies

s13G, 13H, 13I, 13J of the Act

Related companies will be jointly assessed at the General Rate for all land held by members of the group of related companies.

Two companies will be related if:

- one company controls another company;

- the same person (or persons together) have a controlling interest in both companies;

- one company together with its shareholders controls another company; or

- one company is the trustee of a fixed or unit trust and the other holds more than 50% of the beneficial interests / units in the trust.

where control and controlling interest means:

- controlling the composition of the board of the company;

- having the ability to cast or control[1] more than 50% of the votes at a general meeting of the company; or

- holding more than 50% of the issued share capital of the company.

The group of related companies:

- if a company is related to any one or more companies within a group of related companies then that company will be included in the group; and

- companies may be related to each other via a company that does not hold land in SA.

Exception: A company may apply to the Commissioner to be assessed individually if it holds land for development of more than 10 residential lots.

[1] “controlling the composition of the board” and cast or control” votes is not defined in the Act. Assume relates to persons acting in different capacities ie. if person in their own capacity and as trustee of a trust could cast more than 50% of votes then they would be “controlling”. Assume that consideration of affiliates is not relevant.

Ex Gratia Relief

Ex gratia

- Land Tax transitional fund: 100% relief up to $50,000 (in 2020-21 year) where there is a greater than $2,500 increase in a taxpayer’s assessment. This does not apply to land subject to trust rates and so is unlikely to be applicable in many instances because the individual rate has decreased. It may be worth considering this further if an individual is the nominated beneficiary in respect of a discretionary trust and thereby assessed to a greater amount of Land Tax.

- Affordable housing concession: relief equal to the difference between their tax liability and the tax they would be liable for if each affordable housing parcel were to be taxed individually.

- Affordable community housing land tax exemption pilot: 5 year limited scheme for up to 100 properties rented through registered community housing provider.

Land Tax Planning

Take action now

It is crucial that all landholders review their current holdings and make appropriate notifications. It is also important to consider the appropriate landholding entities for your future property purchases.

Step 1: You can use our Land Tax Calculator at www.cartlandlaw.com to calculate your potential 2020-21 Land Tax liability under different circumstances (i.e. with and without notifications) to determine the best outcome for you.

Step 2: Asset Protection:

Whilst nominations do not presently have any income tax or capital gains tax effect, ensure that when you are making nominations, you also consider succession planning, income tax, the eventual distribution of CGT, and any asset protection risks. For example, if you intend to ultimately pass control of a trust to one of your children but nominate another child as the designated beneficiary, they will be entangled on an ongoing basis.

Nominations do not create any equitable interest and so should not cause any asset protection problems from the perspectives of bankruptcy or family law. However, family court is often unpredictable, and a nomination has the potential to suggest that the trust belongs to the nominated beneficiary. Therefore, we suggest you should consider this if nominating someone who is at risk of matrimonial action.

Step 3: Restructures

In many instances, it may be suitable to restructure property holdings to effectively manage your land tax. In certain circumstances, it may be viable to transfer property (particularly commercial property) out of a discretionary trust to separate ownerships assessed at the General Rate. I note that Commercial properties can be transferred without stamp duty, but land transfer and conveyancing fees will still be charged.

If property is held in a company, is possible to structure it to ensure the capital gain is made in a related trust. This is useful for property which will generate positive revenue so that it is taxed at the corporate tax rate, but CGT is taxed through a related Discretionary Trust. Something like a purchase warrant could achieve this.

Step 4: Rules of Thumb When Making New Purchases

- Utilise the General Rate

utilise the General Rate by holding land as individuals, in separate companies (i.e., not part of a group of related companies), and in your SMSF where appropriate. When establishing companies, be careful not to accidentally create a group of related companies.

- Hold Land in Separate Discretionary Trusts

Try to hold separate parcels of land in separate discretionary trusts where possible; The higher Trust Rate will apply, but the land will be disaggregated and may reduce your overall Land Tax.

There does not seem to by any reason why a property could not be separated into 50 different trusts. However, it seems to be the intent of the legislation that no anti-avoidance provisions will apply because the trust surcharge would apply instead. Also, the trust aggregation rules have been expressly removed from the Act, and so these trusts would not be grouped. Notwithstanding this, we caution against an overly aggressive splitting of properties into different trusts based on our experience dealing with RevenueSA. We expect that in a couple of years, such arrangements may come under scrutiny. Ideally, ensure there is some reason for splitting titles between discretionary trusts, for example, because different titles would later be divided and sold or passed to different children in accordance with succession planning.

Example

Consider 10 properties each with a land value of $250,000

Current tax if aggregated = $59,479

Current tax if one title per discretionary trust = nil

New tax if all aggregated at the standard rate = $38,452.50

New tax if all aggregated at trust rate = $44,950.50

New tax if one title per discretionary trust – no nomination = $12,500

New tax if two titles per discretionary trust – 5 different nominations = $1,250

- Land tax and asset protection.

The default structuring entity for purchasing land has been a Discretionary Trust because of its ability to stream income, capital gains and offer asst protection in the event of a beneficiary going bankrupt. Because of the Land Tax surcharge, there may be many cases where it would be more efficient from a Land Tax perspective if the property is owned by an individual (so as not to incur the trust surcharge). In this instance, there are a couple of options:

- create an equitable interest such as a mortgage over the property, which is held by a discretionary trust. Interest would accrue on the equitable second mortgage, and this would hopefully keep the value of the equitable second mortgage absorbing all of the value in the property as it increases over time. For land tax purposes, the equitable second mortgage are ignored and look only to the legal owner.

- hold land a unit trust with income units and capital units held by separate entities. This works because, for Land Tax purposes, the holder of the capital units is deemed to be the owner, and the income units are held elsewhere, then income can be distributed out to a desired entity. For example, you may have the capital units held by an individual but the income units held by a discretionary trust which can then be distributed across in accordance with your normal tax planning. Another variation, the capital units could have their interest removed or limited in the event or bankruptcy of the individual. In this way, asset protection could be achieved.

If you have any questions about Land Tax or would like to talk to one of our team about your specific circumstances, then please contact us, and we will be pleased to assist.

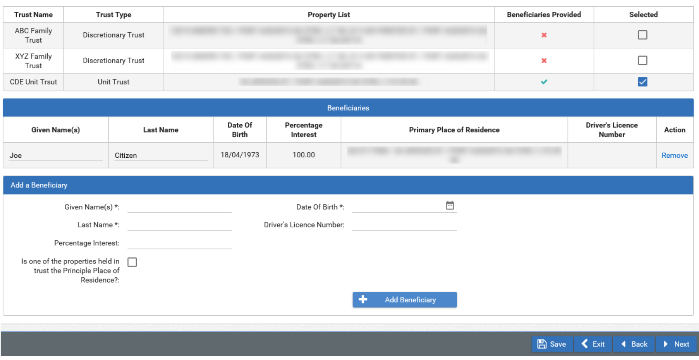

Using Revenue SA online

You can access the Revenue SA Online portal to provide information about your trusts and nominated beneficiaries.

Your Revenue SA Online portal will look something like this:

For each trust, you are required to upload a significant amount of supporting documentation, including:

- a copy of the Memorandum of Transfer showing that the consideration was paid by the Trust or on behalf of the trust; or

- most recently completed and lodged Tax Returns for the trust, clearly showing the land as an asset of the trust.

If you are unable to provide the above documents, then you must provide at least two other types of evidence from the following list:

- a copy of the Memorandum of Transfer for the purchase of the land, showing “with no survivorship” or “WNS”;

- Title showing “with no survivorship” or “WNS”;

- signed Minutes of Trust Meeting (or similar), evidencing/discussing the purchase of the land on behalf of the trust;

- Balance Sheet of the trust, showing the parcel of land as an asset of the trust;

- Settlement Statement for the purchase of the land, showing the purchaser (you) as trustee of the trust; or

- signed Contract of Sale for the purchase of the land, showing the purchaser (you) as trustee of the trust.

For each nominated beneficiary, you are required to upload a Statutory Declaration which can be found here: