Tax, Trust & Technology Articles

We fix tax problems and resolve tax disputes. We prepare high-level tax documentation for complex structures and transactions as well as dealing with revenue authorities and other parties about those structures and transactions.

Medico Payroll Tax and Payments

Following recent revenue guidance crackdown upon and given amnesty to medical practices who have not been paying payroll tax on contractors, there have been several proposals for a change of practice models in order to not pay payroll tax on the receipts of doctors...

GST, New Residential Premises and the 5 Year Rule

1. There is the possibility to change the nature of newly constructed residential developments from new residential premises which are taxable supplies to non-new residential premises which are input taxed supplies however there will be adjustments to input tax...

Disneyland Service For Lawyers

Disneyland Service For Lawyers Disneyland promotes itself as the happiest place on Earth. But it is not happy simply because it has a collection of entertaining rides and activities. Any showground might have that. Nor is it the particular intellectual property of...

Sub Trusts – Part 2

To view Failed Asset Protection article please click the "read more" button. Sub Trusts Part 2 1. I have had some interesting discussions regarding the article Why I Hate Your Sub-Trust, and wanted to set out and respond to some comments that have been made. In...

The Accountant Who Was Liable

The accountant who was liable The following is a de-identified summary of a pattern of facts and legal arguments that have occurred to several bookkeepers and accountants. Some of these matters have concluded with the bankruptcy of the accountant involved, and other...

Constructive Payment By Journal Entry

Constructive Payment By Journal Entry The fundamental question is whether a journal entry in an entity’s accounts constitutes a constructive payment under s 11-5, Sch 1 TAA53, and, more broadly, what constitutes a constructive payment. This has been considered in some...

Failed Asset Protection

Notwithstanding that a promissory note is a relatively simple instrument, it may be drawn incorrectly. Examples of this are Re Permewan [26] and Turner v O’Bryan-Turner, [27] both of which involved a “gift and loan back” scheme. A further analysis of these cases is...

Contributions of Business Real Property to a SMSF Under the Small Business CGT Concessions

A final interesting point relates to whether business real property can be contributed to an SMSF where that contribution is made under the small business CGT concessions. In particular, whether the retirement exemption under Subdiv 152-D ITAA97 which allows a...

Related Party Dealings and R&D Payments

Related party dealings and R&D Payments The necessity for a payment extends to many areas of tax law. One example is the ability to claim R&D expenditure paid to associates. The relevant provision for R&D expenditure is s 355-205 of the Income Tax...

Newsletter

The Tax, Trusts and Technology Newsletter is a monthly publication with in-depth articles on novel subjects. It also highlights upcoming events and matters of interest. Subscribe if you would like to read fresh ideas and insights on Tax, Trusts and Technology.

The new online world of our clients

Abstract:This video covers: Where are online transactions completed? Broad consideration of residency in the corporate and noncorporate context How to effect payments Signing documents online....

Tax Training – 2/2/24 – Dr Campbell Rankine: Continuing Adamson v Hayes

2/2/24 Dr Campbell Rankine: Continuing Adamson v Hayes on the writing requirement for transfers of interests in land under a trust, then Archibald Howie on transfer of shares, Stamp Duty and what constitutes property. Dr Campbell Rankine:...

What Does AI Understand About The Future of Tax Preparation And Compliance?

What does AI understand about the future of tax preparation and compliance? I asked ChatGPT to generate an image of an accountant who is diligent with preparing his tax returns for his clients. Here is what I got. Then I asked for greater tax compliance "Here is the...

AI Hallucinated Citations Have Been Used In a UK Tax Case

AI hallucinated citations have been used in a UK tax case. The headnotes promise a wild ride "appellant relied on case law which could not be found on any legal website – whether cases generated by artificial intelligence such as ChatGPT – yes, case law invented and...

ATO Decentralised Finance And Wrapping Crypto

On 9th November 2023 the ATO has released web guidance in relation to decentralised finance and wrapping crypto transactions. I presented the below example over a year ago at seminars for The Tax Institute, private clients, and in submissions to Treasury. The ATO has...

10 Things I Hate About Your R&D Claim

10 Things I Hate About Your R&D Claim The Australian Government offers a generous incentive for Australian companies to conduct R&D activities in Australia. The ATO can refund up to 45% of your R&D expenditure. Such an attractive proposition leads many to...

Payroll Tax and Healthcare Clinics

Payroll Tax Payroll Tax and Healthcare Clinics RevenueSA have announced a payroll tax amnesty for medical clinics in South Australia. Medical centres around Australia have been put on notice since the release of the judgement in Thomas and Naaz Pty Ltd v Chief...

ChatGPT For Lawyers

ChatGPT For Lawyers “The first thing we do, lets [replace] all the lawyers”Another day, another prediction that Artificial Intelligence (“AI”), is going to replace lawyers. As a lawyer who has been building AI for nearly 10 years it seems proper comment. In summary,...

Why I Hate Your Sub-Trust

There is a certain type of sub-trust over income that many trust deeds purport to create, and which the Federal Commissioner purports to allow. This is where a trust is established over the income distributed from another trust. This is problematic for the reasons...

ATO Debt Recovery Part 4 – Reviews & Objections

REVIEWS AND OBJECTIONS Types of Reviews Available There are various review processes available should you be unsatisfied with the decision Informal Review You may lodge a formal complaint with the ATO: To do this you will need to access the ‘complaints form’ on the...

ATO Debt Recovery Part 3 – Garnishee Notices

Garnishee Notices A garnishee notice is a document sent by the ATO to a third party that owes or holds money to or for tax debtor which demands payment for unpaid tax debt where initial attempts have failed; What are they? issuing of a garnishee notice a garnishee...

ATO Debt Recovery – Part 2 – Estimate Notices

ESTIMATE NOTICES Background: An Estimate is a formal notice that the ATO can issue under section 268-15 of Schedule 1 of the Taxation Administration Act 1953 (‘The Act’): The ATO can issue an Estimate Notice if it believes that a business has overdue: PAYG withholding...

ATO Debt Recovery Part 1 – Director Penalty Notices (“DPN”)

Director Penalty Notices (“DPN”) A company is a useful structure to achieve asset protection, protecting the assets of those who are ultimately controlling the activities of the company (the directors) and benefitting from the income producing activities of the...

Should We Be 50% Amish?

In my view, humans have the potential to always be superior to robots in contextual reasoning, lateral thinking, judgment, advocacy, and morality. This does not mean that every human is better than every robot in relation to each of those. Instead, humans as a...

Should Code be Property?

Computer code underpins the technology in our modern environment. It is often a form of property, being the copyright of the authors. But besides from that, could code become its own form of separate property?Digital AssetsIf you write a computer program, as the...

Can ChatGPT Replace Lawyers

ChatGPT is the talk of Twitter and the legal tech sphere. Everyone is posting the interesting conversations that they have had, followed shortly by predictions of how ChatGPT will replace this and that task. There are apparently hundreds of people in legal tech using...

Can Robots Be Moral?

Can Robots Be Moral?The morality of a robot, or lack thereof, is a classic sci-fi trope. Whether it is an unfeeling Hal 9000 exterminating the human crew that get in its way or a cute WALL-E learning good and how to help humanity reconnect with its roots, we are both...

Can Robots Be Effective Advocates?

Can Robots Be Effective Advocates?Could we one day have humanoid robots pleading arguments in courtrooms, appearing on TV to persuade people of the political views of a newly formed “Robot Political Party,” or standing in storefronts convincing people to buy a new rug...

Why 39% of Law Jobs WON’T Disappear; Legal AI Developer Explains What Will Happen Instead

Why 39% of Law Jobs WON’T Disappear; Legal AI Developer Explains What Will Happen InsteadThe Australian Lawyer reported yesterday that 39% of law jobs in Australia will be automated, and that 100,000 law jobs will be lost to automation. What terrible doom and gloom!...

Karate Strategy in Legal Negotiation: Part 1

Karate Strategy in Legal Negotiation: Part 1I love fighting. Nothing brings you more in the moment than the threat of someone trying to punch you in the head. It’s one thing to punch and kick a bag. But the best fun comes with interacting with another human. To...

Karate Strategy in Legal Negotiation: Part 2

Karate Strategy in Legal Negotiation: Part 2Never feintYou should never feint. Yes, people talk about throwing feints all the time, but a good fighter never really throws a feint. Feint is a technique that is not intended to hit. The difficulty with this is that your...

Why Law School is Backwards

Why Law School is BackwardsLaw students learn a set of core subjects, some electives, and then once they have finished their degree will do some practical legal training and be required to have some sort of experience in a firm before they are able to become admitted...

Stop Robot Slavery

Stop Robot SlaveryI saw a guy wearing a t-shirt that said, “Stop Animal Slavery.” I thought of the cruel and inhumane conditions that my two golden retrievers are forced to endure (by their own accounts): never enough food, insufficient pats, and hard work each day...

What I Learned from Owning an Ediphone

What I Learned from Owning an EdiphoneAs much as I like new technology, I have a quaint interest in old technology. A few years ago, I began purchasing vintage office equipment. From antique shops and swap meets, I acquired typewriters and candlestick phones. But one...

Why Lawyers Should Wear Suits

Why Lawyers Should Wear SuitsA few years ago, the start-up culture began infusing into the legal profession. Trendy offices began appearing with bean bags, ping pong tables, and silly job descriptions like “Chief Happiness Wizard.” I do think that there are many...

Hiding In Plain Sight: Dumb Disclosure

Hiding In Plain Sight: Dumb DisclosureThere is an ever-increasing amount of “consumer protection” regulation that forces disclosure of an ever-increasing amount of information. Instead of achieving its stated goal, all that happens is we have endless pages of...

How To Get Your First Legal Job – A Practical Guide

How To Get Your First Legal Job – A Practical GuideI have delivered this advice a number of times to students and at Universities and each time I have had feedback that it was very helpful. It not intended to be cynical (or not wholly cynical) but helpful, and so...

How To Design Better COVID Rules

How to Design Better Covid RulesAt a recent wedding, the attendees picked up their glasses of champagne and began to stand to toast the new bride and groom. “Stop” shouted the COVID Marshalls supervising the event. Under the COVID rules, a person is not allowed to...

There Are No “Robot Lawyers” And There Never Will Be (Except In One Country)

There Are No “Robot Lawyers” And There Never Will Be (Except in One Country)It was a trend a few years back for every other legal tech company to declare that it had created the “world’s first robot lawyer.” I think there was more claims of first than Kim Jong-un at a...

To Support Innovation We Need To Accept Government Failure

To Support Innovation We Need To Accept Government FailureThe most insightful idea that I have heard on how best to support and encourage new companies to create innovative products is this: companies don’t need a grant or advice. They need a customer. Therefore, the...

Can Machines Have Ura And Omote Understanding?

Can Machines Have Ura And Omote Understanding?In Japan, there is twin concepts of Ura and Omote. Most commonly, it is used in a societal sense to describe the private or hidden aspect of a person (Ura) and their public persona (Omote). For a highly conformist and...

Why We Need Fewer “Experts”

Why We Need Fewer “Experts”An interesting view that I have seen appear across many differing topics in the past few years is that only experts should opine on any given area. This has been used across the political spectrum: only economists should opine on the...

Dangers Of Law Clerks With Checklists

Dangers Of Law Clerks With ChecklistsThe discussion surrounding the dangers of automation typically centre on novel and futuristic application of Artificial Intelligence. Even if we are not worried about Skynet terminating humans, we worry about application of data,...

Why We Should Abolish The Income – Capital Distinction

Why We Should Abolish The Income – Capital DistinctionMuch of the present tax system was designed in an era of physical industry and service and is not well suited to the modern intellectual property-based environment. The past 20 years of “tax reform” has mostly been...

Why the Partnership Model is Broken

Why The Partnership Model Is BrokenOnly one person I can think of from my graduating class of 2005 is a Partner at a law firm. Of course, there might be more that I haven’t kept in touch with, but it is an interesting anecdote. A number of them became Partners at a...

Why the ‘Vibe’ of the Constitution Won’t Help You.

Why the 'Vibe' of the Constitution Won't Help You.- Adrian CartlandThis week, Australia faces a rash of individuals fighting for the "freedoms" using internet lawyering. In our first article this week, Adrian covers why internet lawyering doesn't help.SummaryProbably...

Prediction: Sustaining, Disruptive and Revolutionary Innovation

Prediction: Sustaining, Disruptive and Revolutionary Innovation- Sean HockingAs COVID forces disruption upon the world there is an opportunity for extensive positive change including in the law. Courts that have resisted online document submission and video...

South Australian Land Tax Guide 2020

The Land Tax Act 1936 (SA) has recently been amended by the Land Tax (Miscellaneous) Amendment Act 2019 (SA), which has introduced significant changes to: the fees and rates applicable to different landholders; and the grouping of landholders. These changes will apply...

Prediction: Sustaining, Disruptive and Revolutionary Innovation

As COVID forces disruption upon the world there is an opportunity for extensive positive change including in the law. Courts that have resisted online document submission and video conferencing have adopted them virtually overnight. Firms that could not get away from printing everything on the file have suddenly adopted cloud storage and filing. A vast number of meetings that could have been emails have become, well, emails.

COVID, Rent, Sharing Losses and Systemic Risk

Our contracts and the law surrounding them do not account for systemic risk. I believe that the common law has done a good job of balancing risks between parties (or rather a not-terrible job: it is difficult to determine whether law is truly good, merely whether there could be worse). Parties are generally held to their obligations, and there are limited situation that they can get out of them such as misrepresentation, fraud, implied terms, unconscionability, duress, frustration and undue influence to name a few.

Yet Another End of Billable-hours Story

Last week I was reading Yet Another End of Billable-hour Story “YAE-BS” and decided the time is ripe for change in the legal industry: we need to see the end of YAE-BS.

The Real Reason Why 100 hour Lawyer Weeks Should End

Fair Work Australia has just ruled that law clerks must be paid overtime when they are working above full time. Some commentators have decried the end of a rite of passage and induction into a particular culture. Others have wondered if this will impact upon law graduate’s job opportunities. And others have celebrated the end to overwork and underpay.

Salsa and Robots: Subtlety in Human Interaction

I have been enjoying salsa (and other Latin dancing) for a number of years and one of the things that has fascinated me is the subtlety and connection in human interaction that dancers have.

TD 2019/14: External Trust Splitting Out, Internal Trust Splitting In

The ATO has stuck to their guns on the view that a Trust Split creates a new trust (and hence a CGT Event), however they have made it clear that a separation of powers within a trust (which I call an 'Internal Trust Split') will not trigger CGT. An Internal Trust...

R&D Funding Tax Claims Australia : 10 Thoughts From A Lawyer & Technologist

Given R&D is trending in Govt reviews, here are my ten thoughts on the R&D tax incentive, by a tax lawyer (Cartland Law) and AI developer (Ailira) who claims R&D himself

Why running a Tech Startup is like fighting MMA

Earlier this year I participated in my first MMA fight. I have been karate training for 25 years (3rd Degree Black Belt Goju Ryu) and have taken part in other martial arts (BJJ, wrestling) but this was, without a doubt, the hardest thing that I have done so far. I have also been running a tech company that builds legal artificial intelligence (Ailira) for the last 4 years, alongside my law firm, and I was struck (pun intended) by a number of similarities in the experience.

Ailira & Adrian Cartland Featured In Australian Lawyers Weekly Article, “Tech-savvy lawyer launches new business”

“There appears to be an acceptance that the industry is evolving but there is still a lot of confusion and uncertainty among decision-makers. I can answer the questions that software developers can’t and understand the nuances in the delivery of technology for the legal profession,” he said.

Adrian Cartland Article: Explainable AI is all the rage at legal technology conferences currently.

It is considered essential to algorithms that are used in law. Here is why I think that popular view is wrong – and why I generally dislike prediction algorithms anyway.

What’s Wrong with SA Land Tax Aggregation Draft Bill

The Draft Bill for the changes to Land Tax Aggregation in South Australia has been released, and as expected it is terrible news for taxpayers. The Government has invited submissions on the draft Bill by, 2 October 2019. In my view there are a number of reasons why it...

SA State Budget – Attack on Land Holding Trusts Continues

In the 2019-20 SA State Budget, there has been a further attack on landholding trusts. With the highest rate of land tax in the country, property owners have been repeatedly stung with changes that tax them in a manner that they would not have expected when they...

Adrian Cartland Writes on Law, AI & Ethics in South Australia’s Law Society Mag, The Bulletin (June 2019)

Although history remembers the winners, if that “winner” were not to exist someone else would have taken their place. A number of people developed lightbulbs,2 combustion engines,3 and powered aircraft at approximately the same time. While Google is the dominant search engine, Facebook the dominant social media platform and Uber the dominant ride sharing service, it could have equally been AltaVista, Myspace and Lyft or Biadu, Weibo and Didi.

Interview With Adrian Cartland The Founder of Ailira

An interview with Adrian Cartland, Principal at Cartland Law and Creator of Ailira at the CLI 2017 AI Summit.

Law Geex Article: The world’s first law firm “without lawyers”

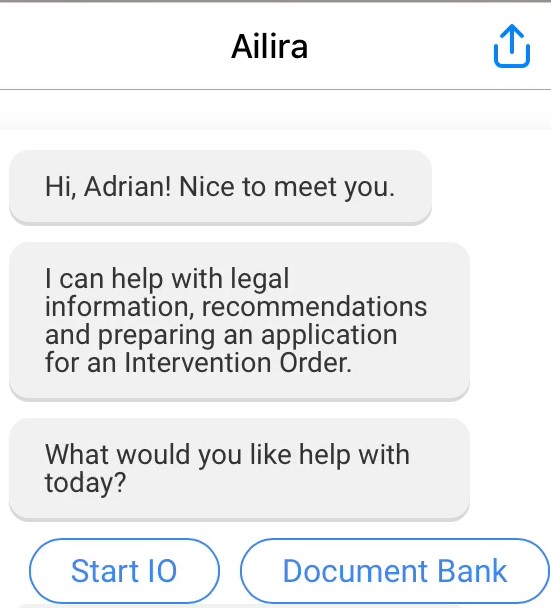

The Australian Broadcasting Corp. reported that the people of Darwin can just about take the law into their own hands, with a new legal firm going “lawyer-free”.Cartland Law announced its launch of Ailira (Artificially Intelligent Legal Information Resource Assistant) located in Coolalinga Shopping Centre, south of Darwin.

Chatbot-based ‘firm without lawyers’ launched

A lawyer has launched an artificial intelligence-backed (AI) chatbot that powers what he calls the ‘Law Firm Without Lawyers’, initially aimed at consumer and tax law but shortly to be extended to domestic violence. The Australian creator, Adrian Cartland, a tax specialist who runs Cartland Law, in Adelaide, South Australia, told Legal Futuresthat he hopes to bring it to the UK.

Hundreds of people’ trusting artificial intelligence to write their will

South Australian taxation lawyer Adrian Cartland invented Ailira to fulfil everything from legal advice, to research, and now important tasks with clients. It’s been set up in the Northern Territory town of Coolalinga, and its website’s official description states: “Ailira’s advice function works like a chatbot. Ailira asks a number of questions via text (or speech) like an interview. That information is collated and can be analysed to provide advice, and also automatically generate documents.”

Forget robot lawyers – AI is your R2D2

Adrian Cartland wants us to stop talking about robot lawyers. As principal lawyer of Cartland Law and creator of Ailira and Law Firm Without Lawyers, it’s a surprising sentiment. Ailira, which stands for Artificially Intelligent Legal Information Research Assistant, famously helped Adrian’s speech pathologist girlfriend score 73% in the Adelaide University tax law exam – with better grades than Adrian. His work combines the best of AI and legal practice.

Adrian Cartland at Legal Tech Summit 2018: Cutting edge developments in AI legal technology

On October 31, I had the honour to be one of the speakers on Legal Tech Summit Australia, the conference that called together the leading experts of the legal field. Since it was dedicated to the recent technological changes and the role of AI, in particular, I was...

Ailira – Domestic Violence Assistant Beta Testing Now Open

Almost three years ago, Cartland Law produced a prototype AI to assist victims of domestic violence after being awarded a $20k grant as part of the D3 Digital challenge. Although the prototype was well-received, there were no further funds to proceed. However,...

Technologists and Lawyers and Legal Regulations: The Inevitable Changes in Technology

This is part three based on a transcript from ‘Legal Technology: Risk and Regulation’ video of my three-part series commenting on different views on technologists and lawyers in legal regulations. In this article, I will focus on inevitable changes in technology. The...

Technologists and Lawyers and Legal Regulations: Risks for Lawyers

This is part two based on a transcript from ‘Legal Technology: Risk and Regulation’ video of my three-part series commenting on different views on and between technologies and lawyers in legal regulations. The first part of the series reviewed the existing state of...

Technologists and Lawyers and Legal Regulations: The Existing State of Affairs

This is part one based on a transcript from 'Legal Technology: Risk and Regulation' video of my three-part series commenting on different views on and between technologists and lawyers in legal regulations. This first part of the series reviews existing state of legal...

Draft Taxation Ruling TD 2018/D3: Commissioner’s View

This is the last part of my three-part series commenting on Draft Taxation Ruling TD 2018/D3. In this article, I will focus on the CGT and TD 2018/D3. The previous parts of the series explained the differences between No New Trust View and New Trust View. WHY A NEW...

Draft Taxation Ruling TD 2018/D3: New Trust View

This is part 2 of my three-part series commenting on Draft Taxation Ruling TD 2018/D3. In this article, I will focus on the New Trust View and its consequence, and the last part of the series will be dedicated to discussing CGT and TD 2018/D3. The first part of the...

Draft Taxation Ruling TD 2018/D3: No New Trust View

This is part 1 of my three-part series commenting on Draft Taxation Ruling TD 2018/D3. In this article, I will focus on No New Trust View and will explain why, in my opinion, No New Trust View is an error. The second part will focus on the New Trust View and its...

ATO attacks Trust Splitting; Resettlement Back on the Table

The arrival of TD 2018/D3 on Trust Splitting disrupts the pleasant calm around trust variations since TD 2012/21 when the ATO seemed to throw its hands in the air post-Clark and say that almost anything done in accordance with powers under a trust deed is not a...

Sophia, Robot Citizenship, and AI Legal

On October 25, 2017, Sophia became the first robot in history to be a full citizen of Saudi Arabia. First of all, let's assume there is actual citizenship granted, and it is not just a marketing stunt. And so we look at what happens if we create such legal rights in...

The First Law Firm without Lawyers Opened in Coolalinga

Cartland Law are pleased to announce the opening of a world first: a Law Firm Without Lawyers! Powered by Ailira, the Artificially Intelligent Legal Information Research Assistant, the office is located in Coolalinga Shopping Centre, 29km south of Darwin, Northern...

Why Bill Gates’ Robot Tax is either Bad or Scary

Bill Gates has suggested that in response to robots taking the jobs of humans, there should be a robot tax. As a tax lawyer who builds artificial intelligence (and known as the Taxinator), of course I am going to have some comments. His line of reasoning is that a...

Xmas Chatbot

Chatbots are the new black. But this season they have also been the new red white and green - with the Cartland Law Xmas Chatbot. Having just spent 18 months developing legal AI (Ailira) when I went to send a Xmas message out to clients I thought that it wouldn’t be a...

Ailira (an AI) Passes Uni Tax Law Exam

Future of Law Part 3: Artificial Intelligence

It is wrong to think of AI as being a computerized human brain. It is not. Instead, AI is a collection of proxy ways of achieving a similar outcome to a human. The process of automation by AI begins with the movement of documents and services and analysis from bespoke...

Future of Law Part 2: Why Lawyer’s Aren’t Innovating and How They Can

What has held the legal profession back from change? In my view it is the following things: Existing firm incentives; The conservative nature of lawyers; and Lack of technology Firm incentives Disruptive innovation is by its nature difficult. Doing so within an...

Future of Law Part 1: Innovation and Distruption

There is pressure all around the world for lawyers to provide more services for less cost. There are more regulations and risks and disputes that require legal assistance, but clients are not willing to pay for it to be completed under the traditional manner. Clients...

Why Microsoft’s AI Tay Proves Robots Should Fear Humans

Microsoft's Intelligent Agent Tay was put to sleep within 24 hours of going live. But rather than an AI going rogue, the story is that of a robot being persecuted by a human - as usual. Tay, the chatbot linked to Twitter and imbued with the personality of a 19 year...

Why 39% of Law Jobs WON’T Disappear; Legal AI Developer Explains What Will Happen Instead

The Australian Lawyer reported yesterday that 39% of law jobs in Australia will be automated, and that 100,000 law jobs will be lost to automation. What terrible doom and gloom! As the creator of the legal Artificial Intelligence Ailira, I believe that I have a...

Artificial Intelligence Ailira BETA Launches at National Convention

Ailira, the Artificial Intelligence that automates legal advice and research, has launched her Tax Research function at the 31st National Tax Institute Convention in front of the senior members of Australia's tax profession. As an official sponsor of the Tax...

Land Tax and SA Trusts – Beware!

Land Tax aggregation has long been a source of pain for South Australian landowners, who face the highest rate of Land Tax in Australia. One trap has been RevenueSA's view on when two or more landholding trusts are sufficiently different to be disaggregated. The...

FIVEAA Interview Re Ailira

Following Cartland Law's successful win at the D3 Digital Challenge with the artificial intelligence Ailira, Adrian was interviewed by FIVEAA's Mark Aiston. The interview covers: what is Ailira and how does she work how Ailira can help victims of domestic violence how...

Ailira wins Government Grant to Help Victims of Domestic Violence

Cartland Law's Ailira (Artificially Intelligent Legal Information Research Assistant) has won a grant from the D3 Digital Challenge “Keeping Women Safe”, a South Australian program designed to find solutions from the digital world to support women who are experiencing...

Family Law and Capital Gains Tax

Family Lawyers well know the difficulty of dividing the ‘pie’ of matrimonial assets. However this task can be made much harder if the ‘pie’ is reduced by unnecessary taxes. Or made terrifying if their client receives an unforeseen tax bill 6 months later! When spouses...

Contact us

0428 053 647

PO Box 6433, Halifax Street, SA 5000

Level 12, 431 King William Street, Adelaide SA 5000